When we wish the Hungarian people a happy new year rich in success, we don’t just vocalise wishes based on mere hopes, but we envisage a fairly likely scenario, one that is based on analysis. A positive vision of the future which the Hungarian economy is able to achieve by relying on its own strength – provided that, unlike in years past, no further, even more serious, world-shattering disasters strike. The government takes the view that the Hungarian economy’s capacity for growth and the directions it is pursuing are more than adequate, and if we manage to avoid the potholes on the path ahead, then the speed of our growth could be significant. In 2024 in the economy we can expect a happier and more successful year.

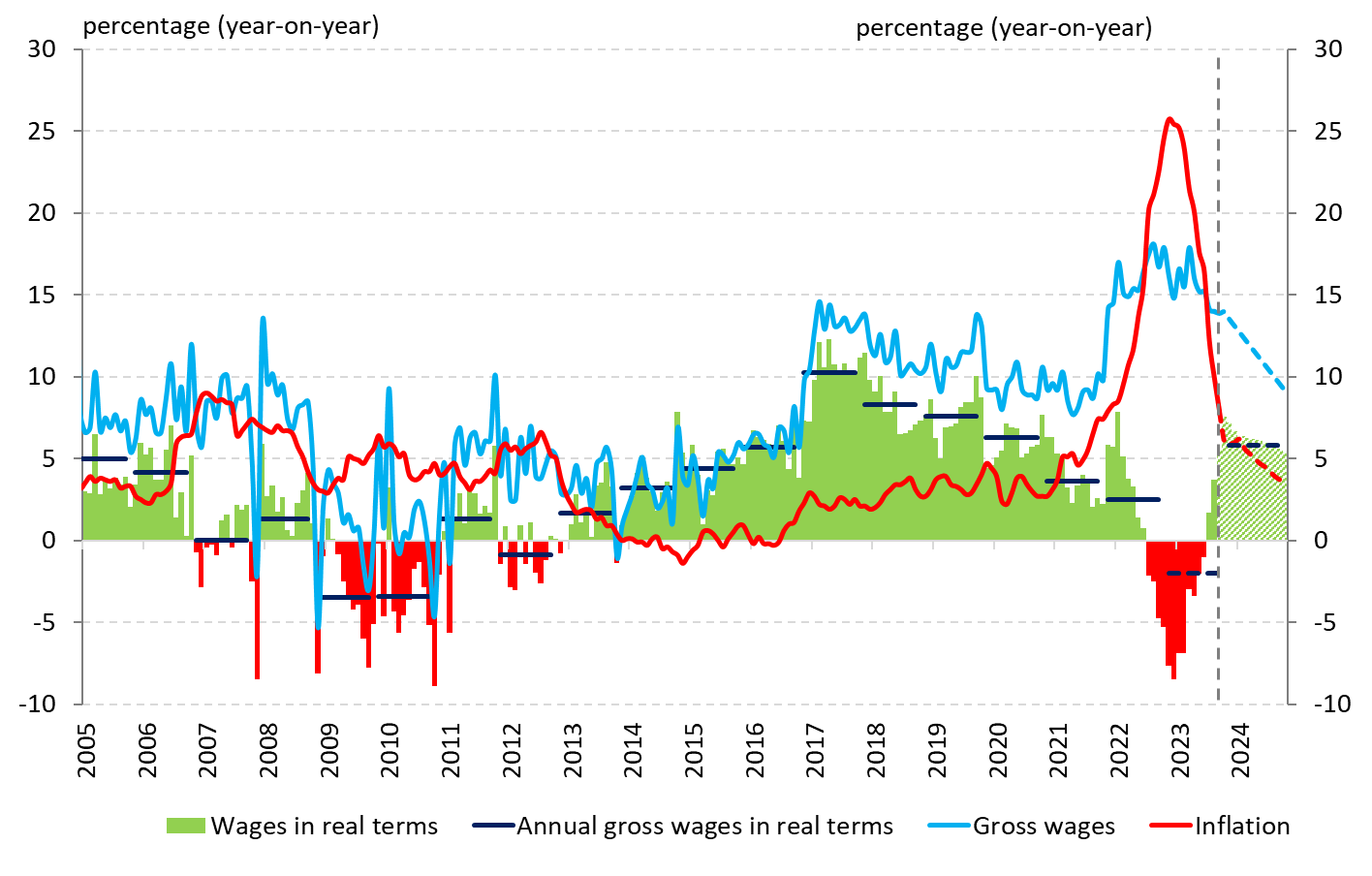

2023 was a year of struggle against the impacts of the war and the flawed sanctions, but as the prime minister stated, it was especially a year of fighting inflation. We began last year by envisaging high inflation, and in consequence, a decline in investment and consumption. Factors eroding our growth towered over us almost exclusively. In a long struggle, we have eventually defeated one of the chief obstacles posing a threat to growth, the phantom of inflation, and so we have succeeded in defending the work-based and pro-family regime that constitutes the very basis of our economic and social system. Regarding inflation, we are now back in the region’s country group; in fact, in November, the Czech Republic recorded a higher year-to-year rate of inflation than we did. Both the Hungarian economy and the government’s economic policy have proved to be crisis-proof, even in the face of the world economy’s headwind we have managed to preserve the foundations of growth and the underlying fabric that guarantees the health of an innovative economy.

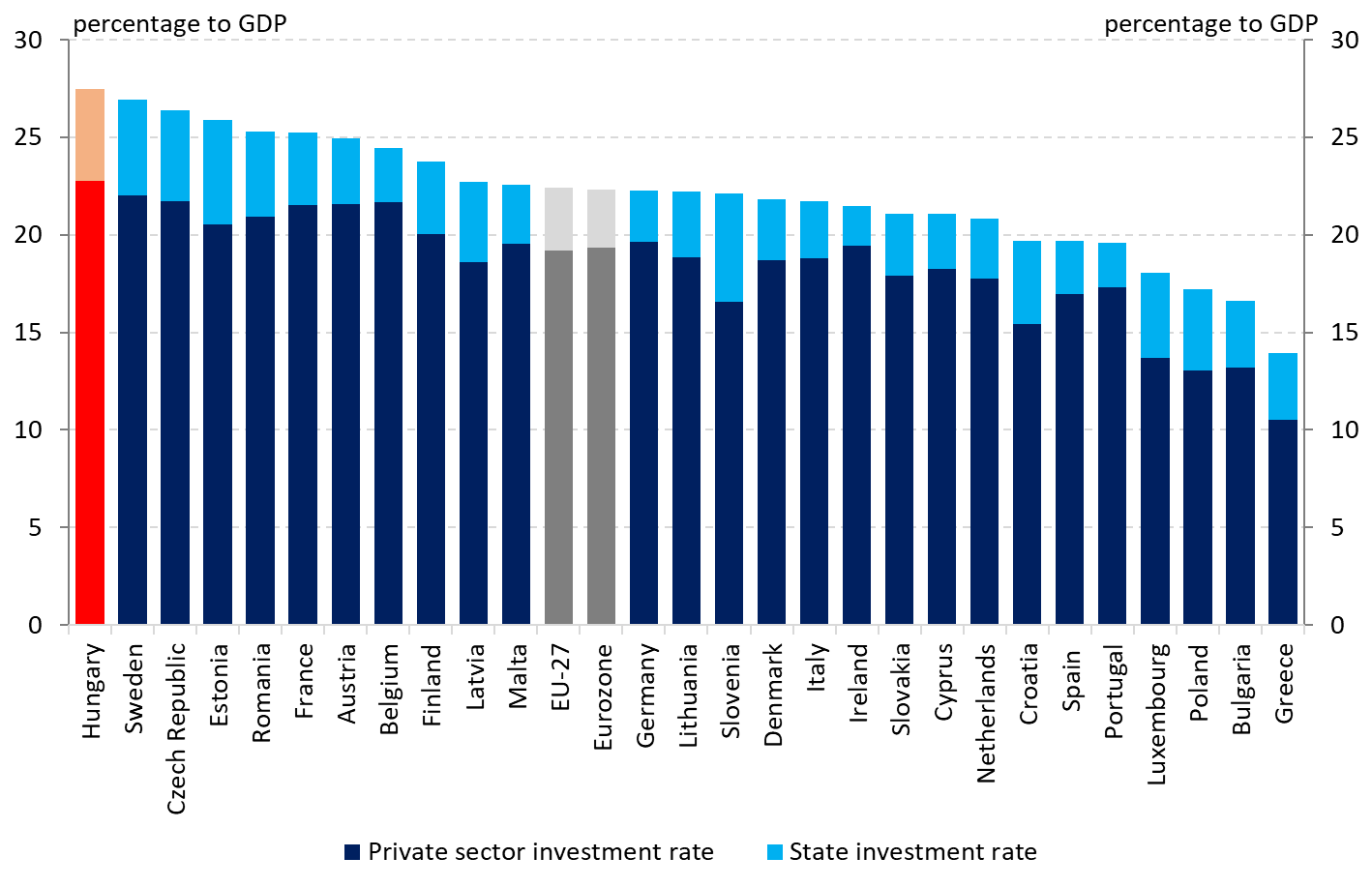

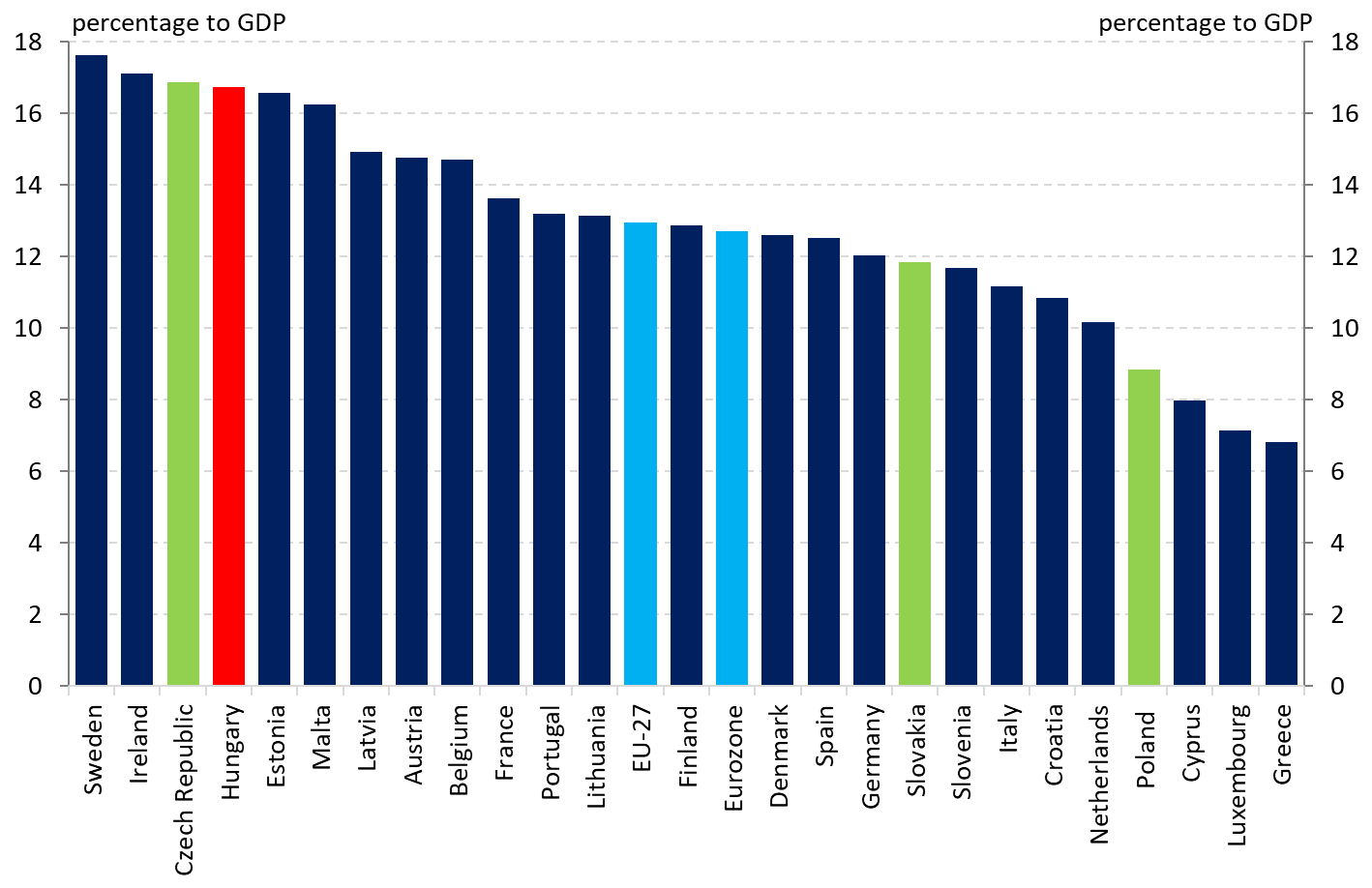

Therefore, a growth accelerating to 4 per cent in 2024 according to our expectations is not wishful thinking on the government’s part, but a direct consequence of the processes of 2023. A swift recovery started from the third quarter on, and economic output is on the rise again – in fact, on a quarterly basis, it is one of the highest in the EU. Our most important balance indicators have been restored, with the passage of the energy crisis our twin deficit, too, is a thing of the past, our foreign trade and external balance are causing ever further positive surprises month after month. This favourable economic outlook was also confirmed by the credit rating agencies in December.

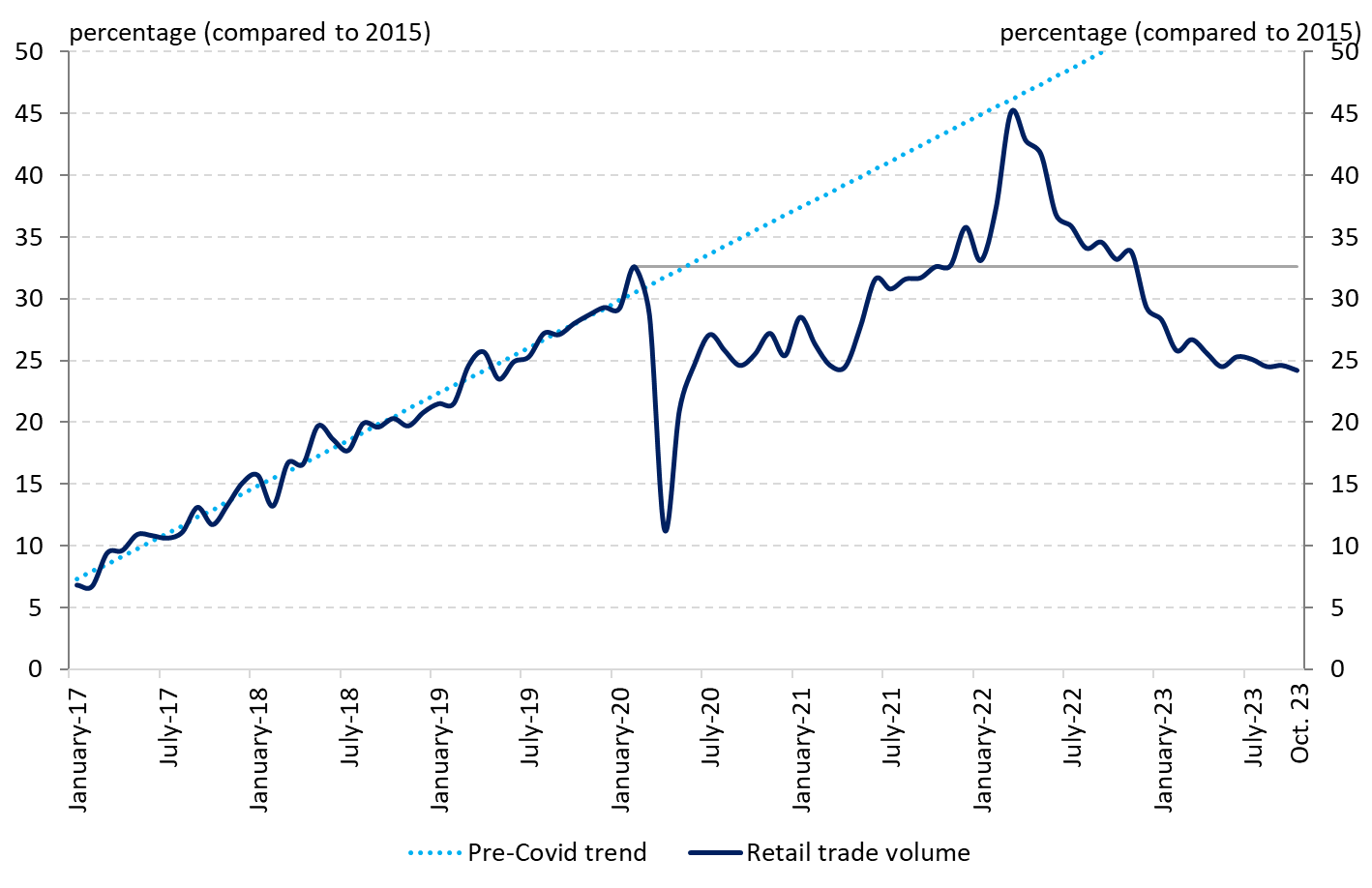

However, a positive economic outlook in itself won’t be enough for guaranteeing economic growth, and the government can’t remain an idle observer – we must continue the earlier proactive and well-targeted economic policy. In order to restore economic growth, we must, first of all, take a step forward in three areas which are, at that, interconnected. As a first step, we must restore retail consumption; as a second step, we must significantly incentivise production and investment in the internal economy; and as a third step, we must further increase the level of activity on the labour market.

I. Restoring the level of consumption

Since 2010, the welfare of Hungarian families has been the number one and most important priority for the Christian-conservative government: we must therefore restore the subjective sensation of welfare and with this, the level of retail consumption because only self-confident, optimistic families will begin to boldly make up for their lost consumption. The rise in real wages which resumed from September 2023 will be an important pillar of the return of growth; in 2024 it will accelerate, approaching the average annual growth of around 5 percent experienced in previous years. The fall in inflation and the dynamic increase of the minimum wage and the guaranteed wage minimum by 15 and 10 per cent, respectively, will play a central role in this. At the same time, a rise in real wages is a necessary, but in itself insufficient condition for the recovery of the economy. We must therefore achieve enhanced confidence on the part of the Hungarian population as regards the country’s economic future, meaning that we must lower the so-called precautionary motive.

Figure 1: Development and forecast of Hungarian gross wages and wages in real terms (2005-2024E)